The role & opportunity for stablecoins in cross-border payments

31 May 2023

Originally published by Digital Bytes.

Stablecoins — cryptocurrencies whose value is (typically) backed by a reserve of assets pegged to a fiat currency like USD — are gaining traction as a new ‘digital asset’ in their own right, and as a potential opportunity for change in traditional financial markets and transaction workflows. Specifically, many payment service providers are considering the potential opportunities presented by this new ‘crypto’ medium of exchange and how they might challenge the traditional, bank-dominated payments status quo.

Created initially as an alternative, less risky, route to crypto investment (and for converting crypto/alt coins into fungible tokens), stablecoins are designed to maintain a more ‘stable’, less volatile value compared to the ‘big boy’ cryptos like Bitcoin and Ethereum — (interestingly, stablecoin can be ‘pegged’ to Bitcoin but that’s an article for another day). Whilst similar in concept to central bank digital currencies (CBDCs) — also very much on the radar in financial markets with respect to their potential in the payments space — there are some fundamental differences between CBDCs and stablecoins. The biggest difference is that CBDCs are, in the main, still at the theoretical, design stage while stablecoins are ‘live’ for specific use cases, and as such are subject to increasing regulatory scrutiny in key geographies. In the UK, fiat-backed stablecoins are slated to be covered by secondary legislation under the Financial Services and Markets Bill 2022–23; new EU Markets in Crypto Assets (MiCA) Regulation will govern issuance and provision of services related to stablecoins (and other crypto assets) while the US SEC is taking a more hard-line view with respect to whether and how stablecoins should be subject to existing Securities regulation.

Stablecoins can be issued and governed by regulated banks and non-bank entities, while, and as their name implies, CBDCs are issued and controlled by central banks. Both use blockchain as the facilitating technology (although CBDCs can also be built on a centralised architecture). While CBDC designs will likely require permissioned, private blockchain structures, stablecoins benefit from being able to leverage multiple open source and permissionless blockchains, and the associated DLT technology within them. Further, stablecoins can be stored in any compatible digital wallet, whereas CBDCs may require a proprietary, government-issued (or other authorised intermediary) wallet. Central bank ‘ownership’ of CBDCs is geographically restrictive since they are being developed primarily for domestic application; while they may have an eye on cross-border interoperability, there are no guarantees around this. Stablecoins, however, have no such geographical constraints and can be used — in principle — as a ‘medium of exchange’ anywhere in the world (as individual regulatory jurisdictions allow).

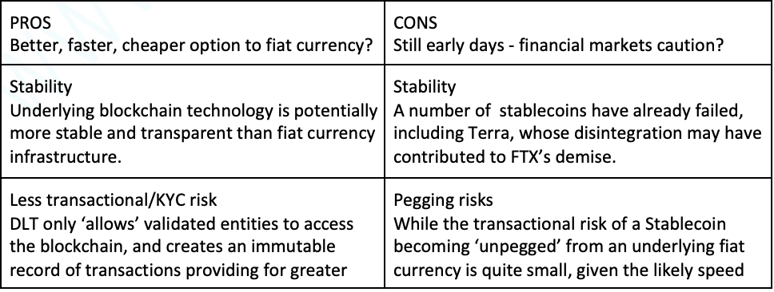

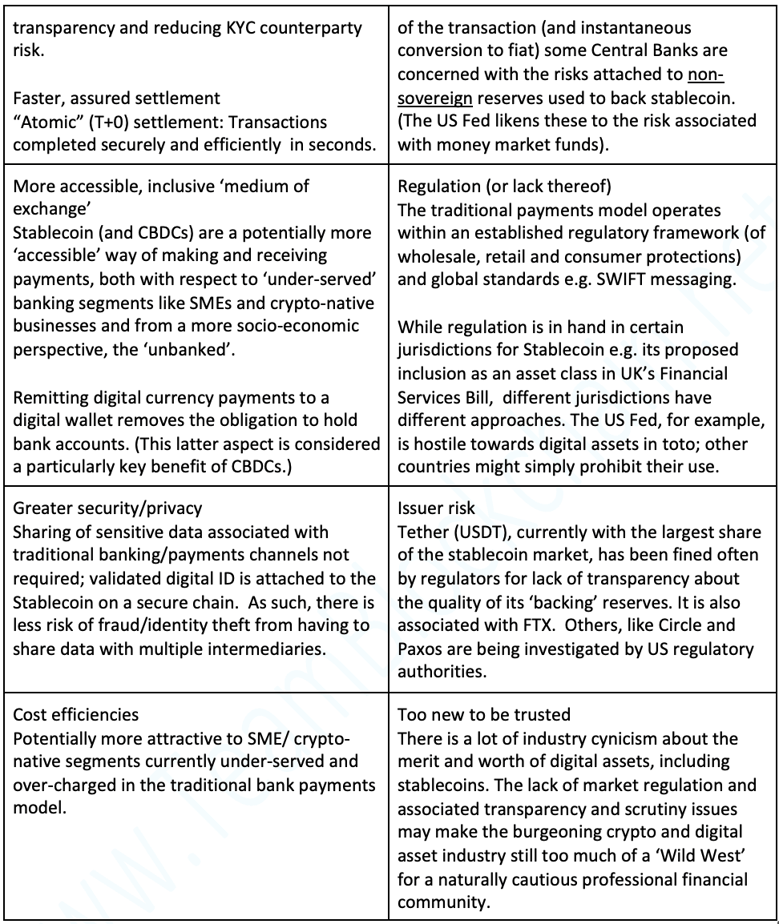

Looking just at stablecoins, let’s dive a bit deeper into their potential merits and weaknesses as an alternative ‘medium of exchange’:

There is no question that the traditional bank-dominated payments model is ripe for change and is already being challenged by the advent of multiple non-bank, fintech-native PSPs (payment service providers). In particular, they seek to address common issues in the payments value chain, including payments speeds of 3–5 days against potential ‘atomic’ (T+)) settlement for digital assets on blockchain, and lack of transparency around missing payments. These new ‘challengers’ also recognise that the traditional ‘correspondent banking’ model is somewhat exclusive and discriminates against smaller firms (and new crypto/digital businesses), both in terms of volume-linked transaction cost scale benefits (how much they are worth as a customer to any bank) and overall from the higher cost of doing business associated with their (relatively) higher risk profiles.

Final Thoughts

Freemarket’s approach seeks to address this imbalance through its aggregation of many bank and Non-Bank Financial Institution connections for efficient cross border payments and currency conversions. By considering the inclusion of stablecoins as a payments and FX currency option, these customers can potentially benefit further from a faster, more stable, more secure and more transparent medium of exchange that leverages blockchain and DLT technologies to assure sender/recipient identities and create immutable transaction records — all of which are potentially ‘at risk’ with traditional payments transactions.

We are ‘watching this space’ with interest.

Related Readings

- Streamlining the Future of Cross-Border B2B Payments Processes

- 6 Biggest Digital Innovations and Trends in Cross-Border Payments 2023

- Don’t be underbanked in the 21st century – free your financial potential

- Why Banking Diversification is the Key to Fintech Survival in 2023

- Levelling Up Your Business in 2023: Growth, Resilience & Stability